Joe Doakes from Como Park emails:

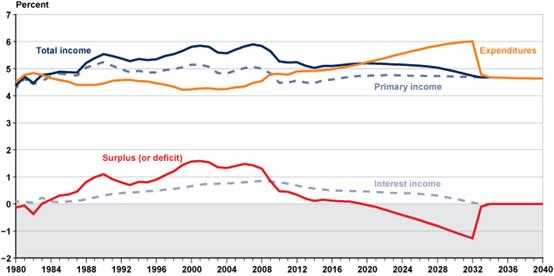

Social Security admits out-go will exceed income in four years and reserves will be exhausted in 2032 meaning the system will go bankrupt, according to this chart:

Congress could increase taxes or cut benefits to keep the system solvent but we all know that’s politically impossible. Sarah Palin suggested Death Panels to kill off elderly ill but Democrats hated that idea (although if Democrats could stack the committee with IRS employees, they might be able to “investigate” Republican medical treatment candidates long enough until they die while Democrat candidates are whisked right through – the panel idea could become popular with Democrats again using that method).

The obvious solution is a massive employee die-off so we don’t have to pay Social Security.

Fortunately, working in an office increases your chance of an early death. Sitting is as bad as smoking. So office workers will start dying just about the time the system runs out of money, meaning all is proceeding according to plan if we don’t let the Health and Wellness Nazis screw it up

Joe Doakes

Not sure who to root for.

Not a problem if the general fund repays borrowed money You omit that undocumented immigrants are paying into social security but are barred from getting anything back out.

We would have a surplus if the cap on social security were raised, which is long overdue given the change in the valuation of the dollar over time.

So sad that the right likes to scare people about social security when there is no real cause for concern with minor adjustments.

But hey, it does distract from all the other things you don’t want to address or have people bring up, doesn’t it?

I never counted on SS paying me back. Ponzi schemes, even really big ones like SS have limits, and the math didn’t add up for those of us just outside the baby boom.

The question is, what will be the next scam government hucksters come up with, can they ever hope to reach the dizzying height of FDR’s triumph?

A huge problem with trying to reform Social Security…..the Democrats have found (to various degrees of success), that they can win elections by saying “Republicans have a secret plan to eliminate social security”, so they block any efforts of reform so they can use that line instead.

Palin didn’t “suggest” death panels. She accused democrats of wanting to include them in Obama Care.

what will be the next scam government hucksters come up with

Kiss your 401K goodbye.

jpa has it right, the murmurs I’ve been hearing on FB from former county govt and union officials(baby boomers) are for the “need to nationalize 401ks” ostensibly to “provide everyone a secure retirement”. Expect this notion to start gaining traction especially with the Sanders crowd once they start getting jobs.

especially with the Sanders crowd once they start getting jobs

Phew… dodged a bullet there since possibility of that is pretty low.

I’ll leave one comment un-whited out just because I feel like it:

“We would have a surplus if the cap on social security were raised, which is long overdue given the change in the valuation of the dollar over time.”

Conservatives (albeit not necessarily Republicans) have been pushing for means-testing and raising caps for years. Democrats and far too many Republicans have opposed it.

“You omit” and ” it does distract from all the other things you don’t want to address or have people bring up, doesn’t it?”

Wrong. I choose to write about some things (as does Doakes), and some don’t make the cut, and some, just get covered by better people for the job than me. I’ve got a job and a life besides this blog. I “Omit” nothing; I just can’t and don’t pretend to write about everything.

Comments involing “you omit” will be mocked. Or deleted. I don’t much care which anymore.

All I can say kel & JPA, I cannot see how a scenario in which the feds go after our 401K’s doesn’t result in some extremely ugly backlash….it certainly wouldn’t if I have anything to do with it.

When I was 30 years old, I was telling leftists I’d give up every cent I’d paid in, for the right to opt out. Too late for that now, there isn’t any left to give up. But I’ll be damned if I’d let them get their filthy paws on my savings.

jpa ..”iPhew… dodged a bullet there since possibility of that is pretty low.

hey their parents won’t live forever!

Comments involving “you omit” will be mocked. Or deleted.

All evidence to the contrary…..

The problem with raising the cap is that it turns SS into a welfare program. There will be a significant number of people who will pay much more into SS than they have any hope of getting out of SS. It will stop being a social insurance program.

My tax returns are in no way unusual — I take standard deduction rather than itemize — and I pay more into SS than I pay in federal income tax. Even if it stays around SS is a terrible deal. If you believe that actuarial tables, I will get out just about exactly what I put in before I die.

When I was just starting out, I worked with some older guys — meaning that they were in their mid 30s — who would hit the SS cap if they put in some overtime. On paper I have a much more prestigious job than I had back then, and I have never hit the cap ($113k this year).

Doggy;

As usual, you’re talking out of your ass because your mouth knows better.

The unfettered theft of the money paid into SS by hard working Americans, by paying it out like an ATM to illegals that don’t pay into it, is the biggest problem. This is followed by the record numbers of people claiming disabilities, because they couldn’t find jobs in Obumbler’s ruined economy.

swiftee: doesn’t result in some extremely ugly backlash

the union boomers who think it would be a Good Idea to nationalize 401ks are suggesting that the first step would be protecting middle class/blue collar workers by instituting an FDIC type guarantee on the first $250k of all 401k accounts with subsequent gradual steps to make 401ks government accounts that employees and employers have to contribute at least 5% of their pay into.

Thanks Baby Boomers, thanks a lot…

The only hope is privitization or major reforms like Frank Underwood proposed. It is pretty insane that even multimillionares get the same SS benefits as some ex-blue collar worker who worked on a assembly line for 40 years does. Something needs to change NOW.

I think the DG comment was allowable; it did at least stay on point, offered a counter-view, and while there’s the usual abuse, we don’t need “safe spaces” here. Best of all, though, it was short!

The brevity is curious; her silence about the shake-out of the DNC leadership and Hillary’s health issues is deafening.

When I was 30 years old, I was telling leftists I’d give up every cent I’d paid in, for the right to opt out. Too late for that now, there isn’t any left to give up. But I’ll be damned if I’d let them get their filthy paws on my savings.

Being that age now I could use that extra $70 they take out of my paycheck every two weeks (I make well under 30k a year, for now). I doubt it will be around by the time I retire.

hey their parents won’t live forever!

It is all about the size of their trust accounts. And handouts from the goobernment. You know, they money they steal from you.

Think about this, my dad literally paid into social security for 45 goddamn years and never saw a dime. Granted he passed away at 60 but still he got the ultimate screw job from the government.

It is pretty insane that even multimillionares get the same SS benefits as some ex-blue collar worker who worked on a assembly line for 40 years does.

The multimillionaire paid into the system the same as the blue collar worker. It is their money too. Means tested system is open to fraud and is just another name for a redistribution scheme and is a sanctioned government theft by the government, for the government.

The entire system needs to be reformed, from premise to outcome. It should be set up more like a charity than a government-run system. What do you think would happen if multimillionaires were allowed to contribute to the system tax-free (an income credit) instead of being forced to pay into it at the same rate as a blue collar worker? Just one idea. I am sure there are plenty others smarter than I who have better.

Charts can be misinterpreted if you don’t read the actual report, which is why I helpfully provided a hyperlink. Read the report, DG.

The government’s own report says we have a surplus in the various Social Security Funds right now, which Social Security lends to the General Fund and in return, receives Treasury Bills. Those T-Bills are the “reserve.” Social Security plans to start cashing in the T-Bills in 2020, when income will no longer be sufficient to meet out-go. That’s the point on the chart where the blue and gold lines cross, four years from now.

DG says: “Not a problem if the general fund repays borrowed money.” Well, sort of true. If Harry and Lloyd make good on their IOUs, we’ll be able to kick the can down the road until 2032 when all the IOUs have been repaid. At that point, there will be no T-Bills to cash and still not enough income to pay benefits. That’s the sharp bend in the red and gold lines on the chart. At that point, Social Security will be unable to meet its obligations, which is the definition of bankruptcy.

So yes, if the IOUs are repaid, the crisis can be delayed. But as a practical matter, the General Fund doesn’t have enough to pay its own bills right now, much less redeem T-Bills; that’s why the General Fund is borrowing from Social Security in the first place. And unless there’s a radical shift in public mood, no significant adjustment will be made during the next administration which means the crossing-the-streams crisis will hit right around the 2020 election, which is a terrible time to expect politicians to stand up for hard decisions such as raising the cap, raising the eligibility age, cutting benefits, etc.

No, DG, I’m not ignoring the contributions of illegal aliens; Social Security knows about them and has included their payments in the income stream. You’re hoping to fund the system with change scrounged from the couch cushions. It’s not enough.

DG says: “So sad that the right likes to scare people about social security when there is no real cause for concern with minor adjustments.” Minor adjustments will not save us because those minor adjustment will not be made in time to save us. There is genuine cause for concern.

.

POD be careful who’s cash you cast your eyes upon; the government doesn’t discriminate who it steals from. Fighting leftist attempts to plunder that rich dude protects you too, and me.

People need to forget about getting their SSI money back; if you aren’t getting it now, you ain’t gonna get it at all. But we need to draw a line in the sand that we are willing to go to the mattresses to defend.

Oh I just want it to be optional, no one should be forced. Like did you know even if you have high quality health insurance at 65 you are thrown into Medicare. Here’s an idea off the top of my head. instead of getting a SS check every month you could opt out and make it tax deductible at 150% so if you are supposed to get 1k a month and you don’t need it you can deduct $1500 off the taxes you owe every month.

Swiftee, there might not be that much money to steal. I’m a government employee. Pension money is taken from my paycheck and “invested” by a government board to fund my retirement. I can select which investment from their choices, but they’re all stock and bond funds.

They’re playing the market with my money. Will I ever see it?

Ideally I’d like to eliminate the IRS and make taxes flat across the board. like say 15% or something. Or a consumption tax, you don’t get taxed on what you make but what you buy, of course that would mean making income tax illegal again like it was pre-1913.

They’re playing the market with my money. Will I ever see it?

HAHAHAHAHAHA!!!!!!! Thanks Joe I needed a good laugh

JustPlain – “The multimillionaire paid into the system the same as the blue collar worker. It is their money too. ”

It is NOT their money and courts have ruled as such. Once the money is transferred to the Social Security Administration if belongs to the Federal Government to do with as they wish. Until they started running a deficit they spent every dime over what they payed out.

DMA, and that is what I meant by “sanctioned government theft by the government, for the government.”

The problem is that folks’ expectations of what Social Security was meant to be has changed over the ages. It was supposed to be a minimal retirement stream to keep folks too old to work from starving to death. There was a cap on the amount of money taken from paycheck for that reason (and to get it passed). You were expected to save or have a pension.

The problem is that it never was a real retirement fund. It’s always been a transfer from workers to retirees because it started paying out right away to keep folks from starving during the Great Depression. And that transfer works just fine, as long as the pool of workers keeps growing. The Baby Boomers proved how that isn’t a given, especially in an environment that discourages having a replacement birthrate.

What I wouldn’t give for Chile’s system. They force you to save, but you own the savings and invest most of it as you choose. It’s like a mandatory 401(k) for the whole country. And those funds have been a great source of capital to help fuel their economy, which helps boost returns in a nice positive feedback loop. Too bad American lawmakers, and Democrats in particular, don’t trust their citizens to handle their own money. But considering how Democrats treat government money, I can see why they would think that other people just like them can’t be trusted with money.

If I could save my retirement money in the Local Credit Union, or invest it in a rental house next door, I’d be all for it. But when I am required to invest in government securities or money markets tied to the stock market, I feel like the Guy in the Poker Game (if you find yourself in a poker game but you can’t tell who the patsy is — you’re the patsy).

Perhaps apocryphal, but Einstein was once asked what the most powerful force in the universe was and he answered ‘Compound Interest’. I’ve thought ‘Birth Rate Demographics’ would be second and US Federal Judge third.

Because Congress through the decades has been placing IOU’s in the SS Cookie Jar, the SS Fund hasn’t been able to capitalize on powerful force number one. And based on this:

http://abcnews.go.com/Health/fertility-rates-drop-lowest-level-measured-us-cdc/story?id=41233697

powerful force number two is coming as the retiree to payee ratio grows even greater.

The European Union solution to this was to invite ‘migrants’ (<30 year old single men, primarily; groppenfuhrer's as they call them in Germany) to offset their long birthrate decline with some new suckers but the migrants decided to assimilate like the average Euro and live off the state.

Something that can't go on forever, won't.

Funny they referred to SS as a “Trust Fund” but all the overages went into the General Fund, so the money could get divided and glad handed for what ever back door deals could get made. Smoke and mirrors they gave I.O.U.’s pushing the debt of SS on and on to the next guy. The pendulum has swung, any knowledge or rational of actuaries might have seen that coming.

Did they ever put the funds into a “Lock Box”?? Too late the Genie is out of the bottle!

A) no such thing as a trust fund. By 2020 payouts exceed income and at that point you are “broke” and start cashing out your “assets” to stay afloat, ASSUMING someone wants to buy it. In this case, Congress has to pull money out of an already deeply-in-deficit general fund; they don’t have the money, either.

B) Forget “tinkering”– raising the rates or caps– all that does is postpone the inevitable and it is how SS has lasted this long, we’ve already done this stupid two-step. Ponzi schemes always die out because they are Ponzi schemes. The system MUST be reformed to a system of private accounts, period.

C) Chile provides a great example of how to do it, but we can’t really go “cold turkey” like they did; we’ve avoided the /right/ approach for too long. Instead, we’re going to have to wean ourselves off of it, over the next 30 or 40 years. Senator Rod Grams had such a plan, mathematically solid, some 20 years ago. Those near or in retirement get what they were promised, the percentage of your SS taxes you can divert to private accounts increases as the contributors get younger, with a corresponding decrease in benefits. As current recipients “age out” of the system, they are replaced with “cheaper” new retirees, who have hefty savings.

The Left says we need to look at how other nations do things to figure out the best way to govern– unless the other nations threaten the government’s gravy train. Socialized medicine, yes, anti-gun laws, yes, but reform of Social Security, no.

They say that SS is an important part of the social contract. The Left apparently have a written copy of what they would like the social contract to be.

Let me tell you something, friend. No government and no political party controls the social contract. If you want to see what it looks like when the social contract frays, look at Venezuela. No amount of government decrees or academic papers can create a social contract.