It’s the keystone of Mark Dayton’s entire plan, if he’s elected governor, for trying to close the DFL’s budget deficit.

It’s “Tax the Rich”.

On Esme Murphy’s WCCO TV show this morning (the program should be called “DFL Puff Piece”, but we’ll come back to that later), Dayton said “the rich” start at $150,000 a year – $173,000 if filing jointly. (The exchange starts at 3:28 of the linked video, with the actual statement around 3:50 or so)

Courtesy of Gary Gross at Let Freedom Ring, here’s the transcript:

MURPHY: You do have a specific plan in which you have called for tax increases for the top 10 percent of Minnesotans. People have pointed out that the top 10 percent includes people that might be in that $136,000 income bracket for single people. You’ve changed that a little bit & said that it’s perhaps people making $150,000. Which is it?

SEN. DAYTON: I’ll send you the news reports going back months now that reference taxable income that has, I guess, confused some people so now I’m going to say total income. But that’s over $150,000 for an individual, over $173,000 for a couple filing jointly. Rep. Emmer says that that’s middle income…middle class. Those are people that work hard for a living but the fact is that that makes them wealthier than 90 percent of the rest of Minnesotans.

And it really obscures the issue. I’m really talking about the rich and the super-rich, the wealthiest 1 percent who make over $1,000,000 a year, over 25,000 households. According to the Minnesota Department of Revenue, pay only two-thirds of the percent of their incomes to state and local taxes as the rest of Minnesotans.

And Rep. Emmer & Mr. Horner don’t want to raise taxes on them by even one penny. And that’s the difference & that’s the issue here.

Here’s another amusing portion of the interview:

MURPHY: Going back to this issue of taxing people making $200,000. What percentage would a couple making $175,000. What percentage would their taxes go up under your plan? What percentage would people making $1,000,000..what percentage would their taxes go up?

DAYTON: Now that I’ve been endorsed, I can enlist the cooperation….the only 3 entities that have the computer capabilities are the Department of Revenue…and the Senate Tax Committee & the House Tax Committee. And now that I’ve won the DFL primary, I will enlist their support.

I don’t have a supercomputer or a large computer capability to do that simulation. What I’ve been saying is that people making $175,000 a year will pay a little bit more in income taxes and someone making $1,000,000 a year will pay more and somebody making $10,000,000 to $100,000,000 a year will pay significantly more. And again, my two opponents are saying that someone who’s making $10,000,000 or $100,000,000 a year should not pay one penny more in income taxes. And meanwhile, everyone else will pay more in higher property taxes or higher sales taxes under their proposals.

Now, that’s pretty ludicrous already; it’s two moderately successful middle managers; a computer programmer married to a contract nurse; a mid-level state administrator and a tenured college professor.

Pretty crazy definition of “the rich”.

But here’s the interesting part: Dayton is lying.

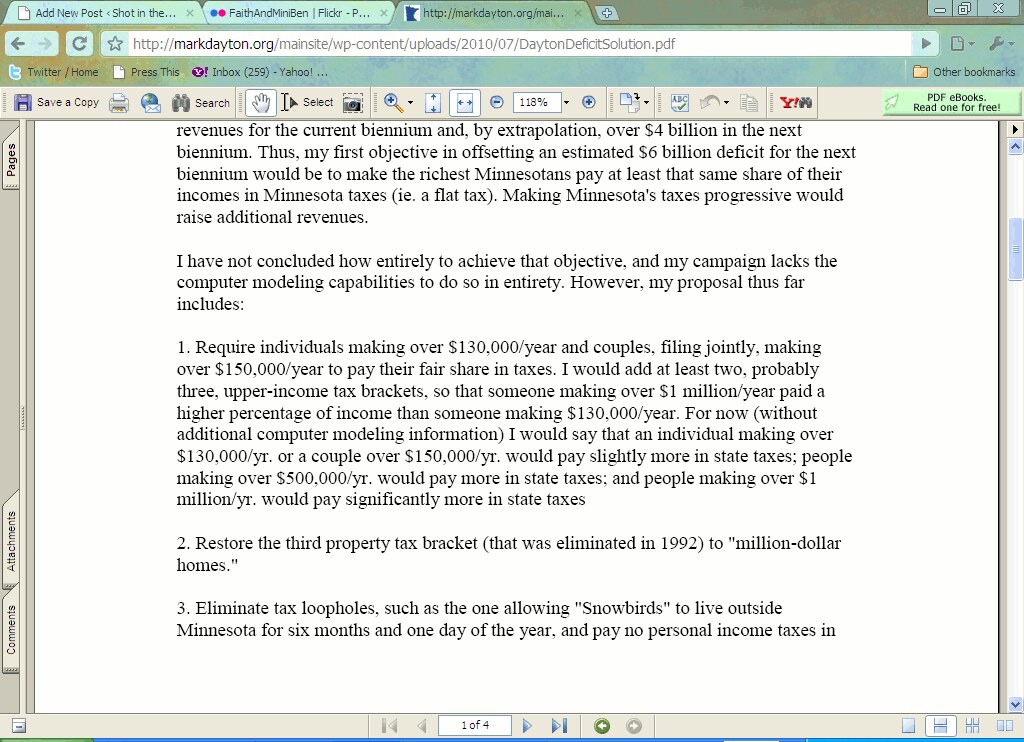

Here’s his position paper on taxes, from his campaign website.

Check it out. “The Rich”, according to the website, start at $130K – $150 for a couple.

That’s a cop and a nurse. A car mechanic and a project manager. A couple of mid level teachers.

You feeling rich, Minnesota?

Leave a Reply

You must be logged in to post a comment.