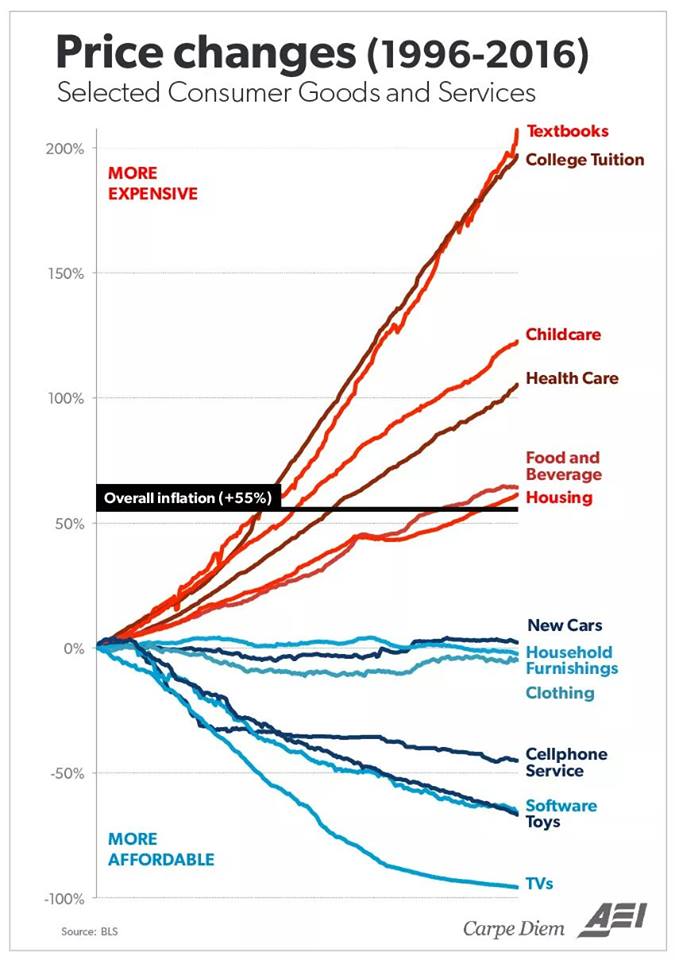

Inflation on some key commodities over the past two decades:

Things with fairly inelastic demand that have been around forever – food and cars and the like – held fairly steady.

Technology in unregulated areas, driven by the free market’s desire to help people keep up with the technological joneses? In free fall (and that’s not even counting price per unit of performance).

Prices in areas heavily regulated by and/or dependent on government? Skyrocketing.

Questions?

Mitch, I think you should start naming these “intended consequences”. Else resident trolls are bound to misinterpret.

To put the television line in the chart into perspective: you could buy a 25″ Admiral console television in 1975 for $700. That works out about $3,200 in inflation-adjusted dollars. I bought a 49″ LG television around the time of the Super Bowl* this year for $321, tax included. So I got a television with about 3-4 times the size of the screen, about a third of the weight, with picture quality you couldn’t even imagine in 1975, for about 10% of the equivalent cost. It’s a marvel.

*Don’t buy your television on Black Friday; the deals are better for the Super Bowl.

When Sanders & Clinton were promising to make college tuition free, it was clear that they did not understand that required textbooks can easily run a student $1000/semester these days.

It’s a racket. You clould teach many subjects (like math) with textbooks that were written half a century ago.

Am I reading this correctly – the cost of inflation over the last 20 years has been 55%? I guess that’s an average of 2.5% per year x 20 years? Wow, that’s a lot of pennies leaking out of my pocket.

If that’s correct, does it mean the amount of purchasing power that I formerly spent on housing and food, I still spend on housing and food? Price is constant adjusted for inflation, right?

So that means cars are actually cheaper? Oddly, that correlates with my own anecdotal observation. I paid $18,000 for a one-year-old Hyundai Sonata in 2010 and just paid $18,000 for another one last month. The price is the same despite inflation. To the extent I’ve gotten cost-of-living adjustments over the few years, the purchasing power required to buy the car has actually dropped.

Bizarre.

This needs to be shown to every millennial and Bernie Sanders supporter. Also I stole this and put it on my Facebook page.

Textbooks are part of the academic gravy train holdover from an earlier era, and a way for the academia beast to keep feeding itself. Probably 99% of the “market price” for these is because the books are required. It’s surprising that they’ve lasted this long in our high-tech life. This will ultimately have to change and they’ll have to find another way to funnel money to the Womyn’s Studies profs (probably through some kind of “reparations” approach if I’m reading the signals from our present culture correctly). Grade school kids today are asking, “What’s a textbook?”

Government creates cartels in stuff you are forced to buy.

There are two kinds of people: people that own or work for cartels and the ones that pay them.

Central bank intervention only creates inflation, asset bubbles, social problems, and government growth.

The Democrat Party is worthless.

It’s a racket. You clould teach many subjects (like math) with textbooks that were written half a century ago.

And take away prof’s gravy train? Surely you jest! Nobody would want to teach any more if not for this graft.

Academia is being chipped at, albeit not fast enough.

Last year, I took 2 classes online through the University of Illinois via Coursera. They accumulated exactly the same credits as they would if I had waded through hairy wymen and beta boys to get to a classroom on campus.

The diff? I paid about 1/3 the cost.

This is the future.

The amount of natural, good deflation that the Fed and government prevents is mind boggling. It’s pure theft.

The more debt you pile under this, the worse it’s going to be someday.

Alt-good, the U of M has something similar for working professionals. I think they charge around $500 a credit. this is the future, the college bubble will burst very soon

Think of all of the overhead and graft in higher ed and the communities it supports. Resolving this is going to be brutal in multiple ways.

Hell, all education, for that matter.

Someday Denise Spect’s annual takeover of the capital will just evaporate.

Pingback: In The Mailbox: 11.14.17 : The Other McCain

The functional blockchain stuff (not even talking about the currency) is just going to pile on the deflation. All of the Western governments are going to print money and resort to more and more police state tactics to save their power. Idiots.

About 1/3 of the way in there is a very good discussion of this http://tomwoods.com/ep-1023-labor-history-the-real-story/

Must listen.

Cartels and inflation are the only reasons the Left has any power.